How The Richest Family In America Got So Rich

The Waltons are by far the richest family in America. Their estimated net worth is somewhere around $215 billion, nearly twice that of their second place competitors, the Mars family. Most of the Walton’s fortune comes from their family company, Walmart, which Sam Walton founded in 1962 with his brother, Bud, in a small town in Arkansas. Although Bud played a role in the company early on, Sam was the driving force behind Walmart’s business tactics and innovations, pioneering many of the programs that brought the company to such widespread success. Because of this, Sam’s three living children, Jim, Alice, and Rob, take up spots number eight through ten on Forbes list of global billionaires, respectively. But while the majority of wealth is concentrated with Sam’s children, even the lesser Waltons are worth tens of billions. In fact, the entire clan collectively owns as much as the bottom 43% of American families, says Politifact.

While the Waltons are famed in the retail world for their business-savvy ideas, they have also been heavily criticized for their treatment of employees. The family has even run into some controversy, namely in using tax loopholes to avoid taxation on their riches and hoarding that amount of wealth in the first place. From business tactics to illegal activity, here is how the Waltons became America’s richest family.

They founded Walmart and Arvest Bank

Sam Walton founded the first Walmart in 1962 in Rogers, Ark. By 1967 Walton owned 24 locations, and he officially incorporated as Wal-Mart Stores, Inc., two years later. In 1980 Walmart reached $1 billion in sales, topping this achievement in 1993 by making the same in a single week. All this is to say, the company has taken off, expanding from classic Walmart stores to Supercenters, Neighborhood Markets, and Sam’s Clubs domestically and internationally. Walmart earned a total revenue of $559 billion in the 2020 fiscal year, according to their corporate website, and is the largest private employer in the entire world with over 2.2 million employees, reports Industry Week.

But Walton didn’t put all his eggs in one basket. Intent on diversifying his portfolio, the patriarch invested in a variety of other pursuits, the largest of which is Arvest Bank. The bank is reportedly worth around $45 billion, and 96% of its shares remain in the family. They also own several smaller enterprises, such as an Arkansas-based newspaper company.

The Waltons perfected a new way to ship

Walmart owes much of its success to careful tracking and planning of its supply chain. To do this, the company utilizes the cross-docking strategy, says Market Realist, in which goods are transferred from trailer to trailer at docking points rather than being offloaded into warehouses. By skipping warehouses altogether, which charge to store items and have high labor costs, the retailer saves massively on the price of shipping. It also allows them to maximize space on trucks, thus saving by not having to rent entire trailers that are only partially filled. Lastly, they save on time, with Walmart-owned Sam’s Club estimating that goods spend as little as one hour and a max of 24 in between shipping transfers, says an annual report from the Securities and Exchange Commission. Roughly 80% of Walmart’s goods are shuttled through these cross-docking facilities in fiscal year 2014.

Cross-docking was invented in the 1930s, although it was used almost exclusively for small truckload or military operations until the 1980s, when Walmart popularized it as a retail strategy. In its modern form, cross-docking allows larger retailers to beat out small businesses, as the costs related to this type of shipping (namely renting or owning a deep enough network of fulfillment centers) does not make sense for small businesses. Edging out even large competitors, Walmart changed the game in utilizing its larger stores as fulfillment centers. This move gave them an advantage even over competitor Amazon, whose physical presence lags far behind that of the Walmart network.

They pioneered the barcode

Although they seem ubiquitous today, barcodes were not found in many stores until the mid-80s, according to the official barcode website, (because yes, that exists). Originally developed as a way to more quickly and efficiently reconcile inventory, Walmart took the technology one step further and began attentively tracking sales. Because of barcodes, Walmart now knows what specific flavors of popsicles or sizes of shoes are bought on certain days of the week and at certain hours. This allowed the chain to anticipate customers’ needs, saving money by ordering the precise amount of products necessary for the time period and avoiding over- or under-stocked items. Additionally, it gives them more bargaining power with manufacturers. As Walmart could calculate exactly how low they could price an item while still achieving a profit, they were able to tell manufacturers exactly how low they needed be on production costs.

Walmart was also a frontrunner on radio-frequency identification (RFID), a microchip embedded in products that acts as an improvement upon barcode technology. The RFID proved its might when out-of-stock merchandise dropped 16% during the first eight months of use in 2005, reports Profit Works.

Walmart had curbside pickup before it was cool

In addition to using their many stores as fulfillment sites, cross-docking allows for customers to pick up specific items at any Walmart location after they place an online order. Because so much movement is already occurring between stores and fulfillment centers, the company can easily promise same-day or next-day delivery on a vast array of items. Other companies have struggled to do this while keeping operating costs down, which are notoriously high for e-commerce, but the physical network Walmart put in place at its impetus helped prepare them for the shift in popularity towards e-commerce.

Walmart first implemented its Site to Store service in 2007, according to their corporate site, allowing customers to place an online order and receive it at a local store. They added grocery pickup in 2013, providing customers with one-stop shopping through their online channel. While this may not seem so groundbreaking, the trend towards one-stop shopping and convenience is driving major players to drastically change their business models. In fact, it is one of the main factors that drove Amazon to acquire Whole Foods. In drawing customers in to stores with products of frequent necessity (such as food), companies are able to generate more sales on all of their products when customers inevitably browse the wider selections.

They outsource to China

Roughly 70% of Walmart’s products are manufactured in China, reports Mother Jones. The company shifted manufacturing overseas in 1996 seeking greater profits. These profits were mainly achieved by paying workers significantly less than in the United States, as well as by favorable tax laws. As estimated by the nonpartisan think tank Economic Policy Institute, roughly 400,000 jobs were lost stateside in the move, despite Walmart’s pledge to bolster the American job market. The Waltons also have over 438 stores in 180 Chinese cities, as of 2020, attempting to remake overseas the same advanced network of physical locations that allows them such success in the U.S.

And American jobs lost were not replaced with good jobs overseas. A 2011 investigation by The American Prospect found that the average pay rate for Walmart factory workers in the Shenzhen area was 59 cents per hour, with overtime rates lower than during the normal work week (which is illegal). Additionally, 88% of employees worked longer than 11 hours a day, and 81% worked more days than is legal under Chinese labor codes. Among a slew of other bad practices, the factories prevented quitting by, “deliberately delay[ing] wage payments by two weeks, and a worker who quits ‘without permission’ forfeits those two weeks of pay.”

Walmart treats workers terribly

One major (although unethical) way to cut costs is to keep worker’s wages low, which Walmart takes full advantage of. Wages at Walmart start at $9 an hour, which means the majority of company employees make less in a year than the Waltons do in a single minute. Additionally, many workers are boxed out of full-time work, instead employed as part-time employees or independent contract workers, so that the company may avoid paying for full-time benefits like insurance. The practice denying full-time status is also in place in Walmart’s overseas stores. This has become an increasingly common strategy in the modern labor market, allowing companies like Walmart and Amazon to rake in billions at the expense of worker health and livable wages.

Walmart employees have alleged hours of off-the-clock working, work assignments that made breaks impossible, and a slew of other wage theft on the part of the company. According to Human Rights Watch, Walmart faced 54 class action lawsuits for illegal labor practices between 2000 and 2006 alone. The maintained poor treatment of workers prompted Bernie Sanders to introduce an act to the Senate in 2018 called the STOP WALMART act. The bill would prohibit companies from buying back their own stock, a practice that uses excess cash to increase the value of the company and concentrate ownership, until they have increased worker pay to at least $15 an hour. The bill would make companies spend excess profits on basic worker protections before increasing owners’ massive wealth.

They leverage 6.2 billion in taxpayer subsidies to make up for low wages

In not making a livable wage, Walmart employees are often forced to turn to federal assistance programs such as SNAP and Medicaid to get by. These programs are federally funded, and a majority of these funds come from American taxpayers. Assistance programs would not be so needed if everyone was paid a livable wage, so taxpayers are essentially subsidizing Walmart’s bad behavior. This is not to say that federal assistance programs are bad, as they allow millions of Americans to achieve better standards of living, but rather that their existence provides companies with an excuse to not adequately compensate workers.

Additionally, the Waltons reap a double benefit from the existence of the federal assistance program SNAP, as they accept food stamps at their locations. This means they are directly responsible for driving people to participate in these programs, and they accept compensation for it when SNAP participants shop at their stores. In 2013, they raked in an estimated $13.5 billion in sales from SNAP recipients, making up 18% of the total SNAP market.

Yet companies like Walmart with owners like the Waltons have all the resources at their disposal to make such changes happen. Americans for Tax Fairness estimated in 2015 that the Waltons could still rake in a $10 billion profit if they gave every Walmart employee a $5 per hour raise. If $5 extra is enough to live on, then who says $10 billion isn’t?

The Waltons practice bribery and foreign corruption

Walmart’s expansion into Mexico came with some unexpected (and illegal) business tactics. Sources revealed in 2005 that Walmart had paid $24 million to various Mexican officials to get ahead. The specific crimes included changing a zoning map that was publicly voted upon so they could build in an off-limits, high-traffic area, expediting building permits to get stores built more quickly, and ignoring protections that make workers safer on building sites, just to name a few. But when Walmart launched an internal investigation, it was quickly called off, and no repercussions were issued. The story was buried until The New York Times caught wind of it in 2012, prompting them to gather and publish “tens of thousands” of incriminating documents.

The fallout was immense. Walmart’s value plummeted by $17 million in a matter of days, says Reuters. Three CEO’s from various Walmart branches “retired” from their positions after sources revealed they knew about and attempted to cover up the illegal activity (although they were still allowed to receive paychecks ranging from $30-140 million that year).

Over the following few years, investigations revealed that Walmart was also responsible for bribing officials in China, India, and Brazil. As noted by The New York Times, the resulting seven-year investigation brought on $282 million worth of fines for the Walmart corporation. Although that may seem like a lot of money, it amounts to what the Waltons earn in roughly three days’ time, constituting little more than a slap on the wrist.

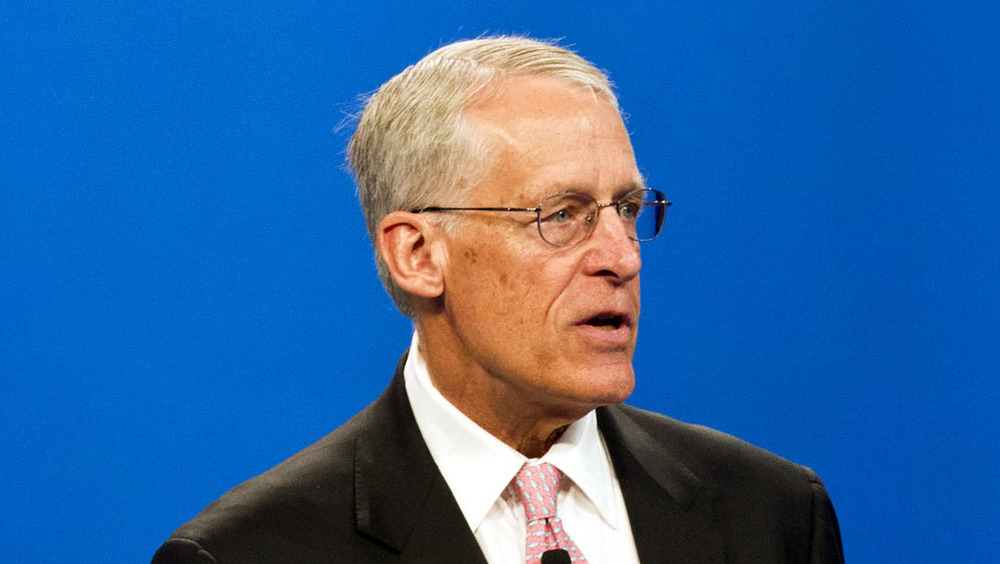

The Waltons continue to work as higher-ups in the family businesses

The Waltons continue their family legacy by working at Walmart and Arvest Bank, as well as at the Walton Family Foundation. Remaining employed as important figures in family operations allows them to continue earning extremely high salaries and maintain their wealth. Sam Walton’s four children, Rob, Jim, Alice, and John, each played a part in the family business. According to the action group Making Change at Walmart, Rob Walton served as chairman of the Board of Directors from 1992-2005, raking in $235,000 a year in salary. Jim Walton serves on the Walmart board, earning roughly $242,000 a year. He also oversees the family’s large fortune as the head of Walton Enterprises, Inc., a wealth management firm reserved only for the Walton family. Additionally, Jim Walton is the former CEO and current chairman of Arvest Bank, of which he owns 96%.

Alice and John Walton took less directly related paths than their brothers. Although Alice no longer works for the family’s for-profit enterprises (she was briefly a buyer at Walmart), she is a board member at the Walton Family Foundation, the family’s charitable arm. John worked as a pilot for Walmart after serving in the armed forces, in addition to being involved with the families charitable efforts, before his death in a plane crash. Both siblings also held jobs in the finance industry as their main means of employment.

They own a majority of Walmart's stock and receive billions in dividends

While working for the family business can earn you a handsome paycheck, by far the largest portion of the Walton’s earnings comes from dividends of Walmart stocks. The family collectively owns about 51% of Walmart shares, or 1,508,965,874 in total, according to the The Washington Post. With current annual dividends for Walmart shares amounting to $2.2, this sets the Walton family up to earn more than $3.3 billion in dividends in 2021 alone.

The greatest portion of these stocks are held by family entities Walton Family Holdings Trust (15%) and Walton Enterprises (35%), although some shares are retained by individual family members. The trust was created in 2015 in an effort to create “an appropriate balance of family and non-family ownership,” according to Walmart’s corporate website. It also allows the family to prevent a large portion of their fortune from being taxed, as stocks are passed intergenerationally, and the dividends they make are not taxed the same as money passed down generationally or even income. In fact, as of 2014, Americans for Tax Fairness estimated that Waltons avoid $607 million per year in federal taxes by reaping the company’s fruits via dividends instead of salaries.

The Waltons utilize tax loopholes when family members die

In addition to dodging taxes via dividend payments, the Waltons saved considerably on estate taxes at the time of their patriarch’s death. As Sam Walton himself noted in his autobiography (via Bloomberg), “The best way to reduce paying estate taxes is to give your assets away before they appreciate.” In order to do this, Sam split his money up into specialized trusts called Charitable Lead Annuity Trusts (CLATs). These trusts work by moving income from the their investments (aka money earned from funds passed down by a wealthy elder) into a tax-exempt entity, in this case, the Walton Family Foundation. Eventually, if a series of money transfers between these family entities equals out, most of the trust can be released to beneficiaries of the non-charitable organization (aka the family members), free of estate or gift tax.

As the top American estate tax rate is 40%, this loophole allows the Waltons to save a significant portion of their wealth that would otherwise go into the treasury. And Sam was far from the only Walton to do this — his wife, Helen, and son, John, also created CLATs for their estate before their deaths. According to Americans for Tax Fairness, this practice allowed the Waltons to divert at least $3 billion back into their own bank accounts, making the Waltons the single largest abusers of the CLAT tax loophole.

The Untold Truth Of Prince Diana's Surprising Panorama Interview

The Truth About Bowling's Origins As A Dark Religious Ritual

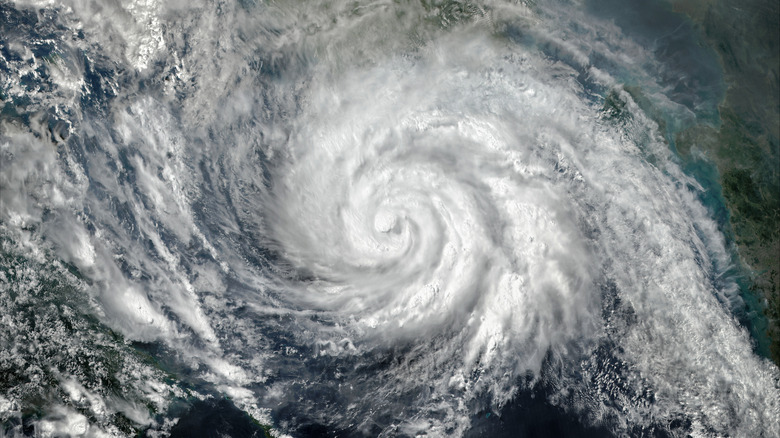

Here's What Would Happen If A Hurricane Crossed The Equator

Cocaine Cowboys: The Tragic Death Of Augusto Falcon's Wife

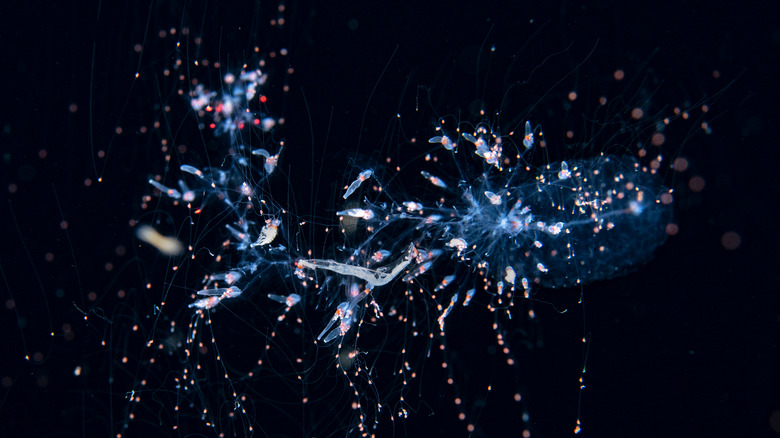

Apolemia: The Creepy Truth About The Alien-Like Lifeform In The Sea

The Real Reason Sharks Hunt At Different Times

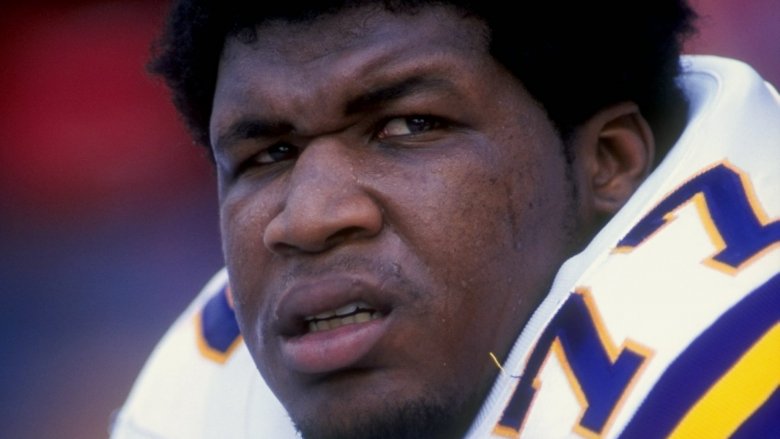

This Was Huey Lewis' Biggest Regret Of His Career

Things Science Got Wrong About The Dinosaurs

What Twitter's First Employees Are Doing 15 Years Later

What You Didn't Know About Koko's Musical Skills