What You Didn't Know About The Duran Duran Board Game

Do you have one of those cool Generation X aunts who you could always go to with anything? The kind

Entertainment,Facts / 2021-06

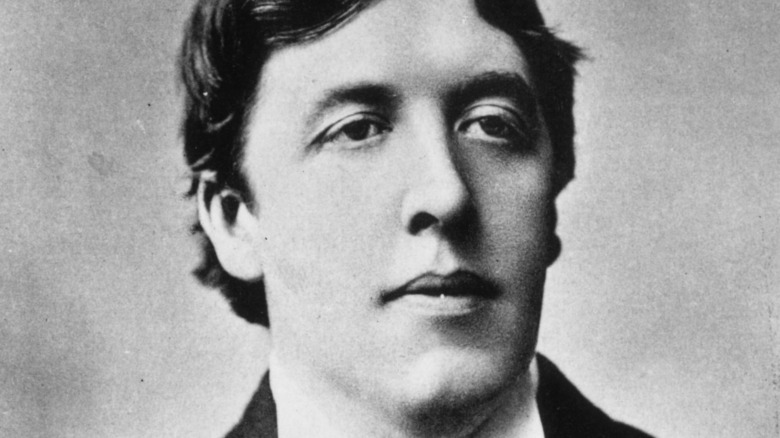

The Heartbreaking Love Triangle Oscar Wilde Was Involved In

The Untold Truth Of Arlington's Tomb Of The Unknown Soldier

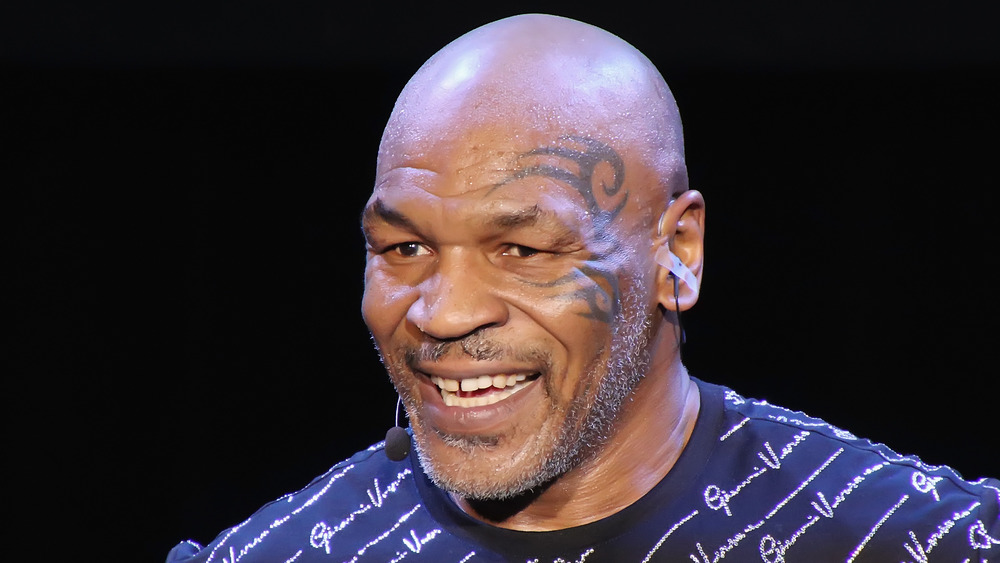

Mike Tyson's Face Tattoo Explained

The Scary Origins Behind Friday The 13th

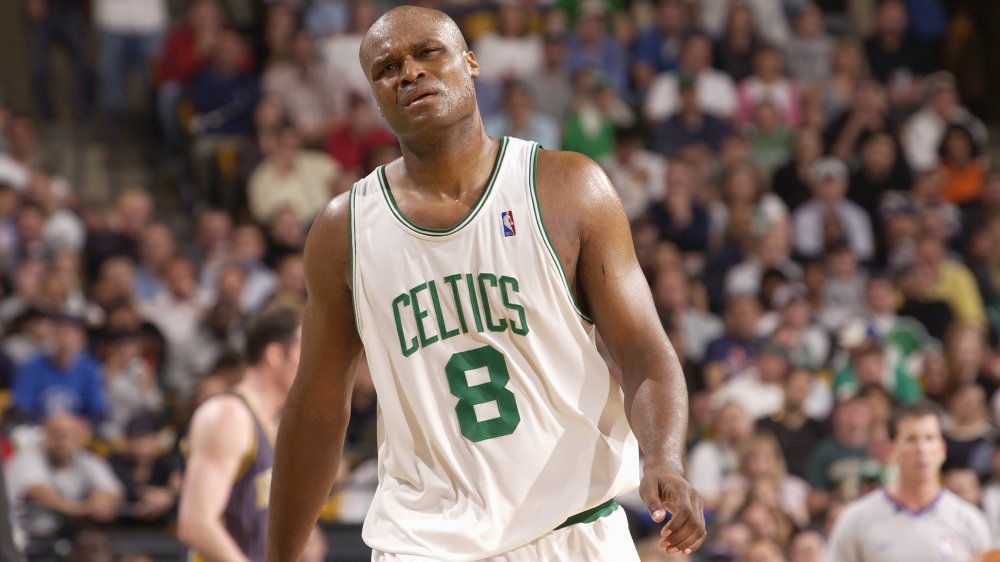

How NBA Star Antoine Walker Blew $110 Million

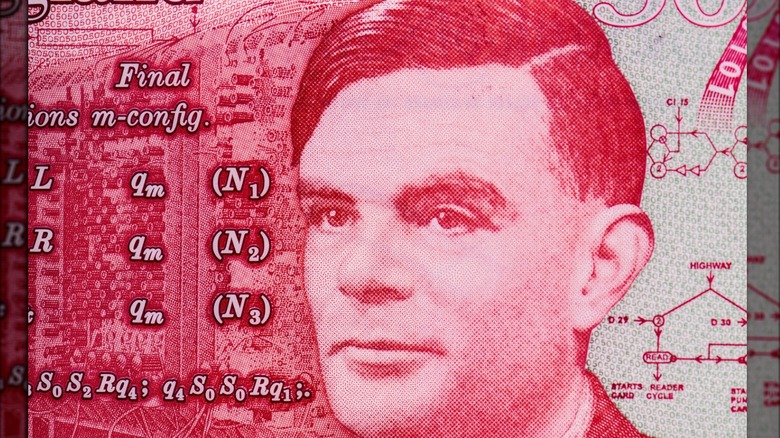

How Alan Turing Nearly Made It To The Olympics

The Most Expensive Aquarium Fish In The World

The Coolest Things Ever Found Buried In Ice

Hitler Was More Evil Than You Thought. Here's Why

The Untold Truth Of Walt Whitman