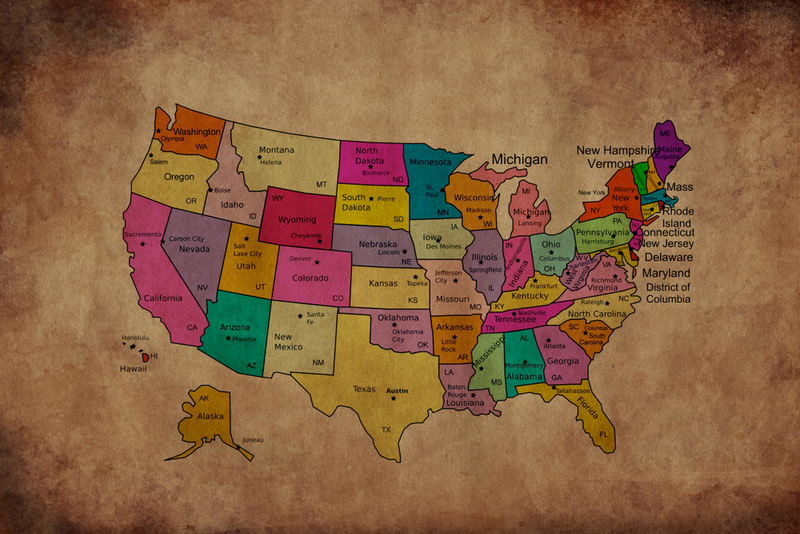

The Best and Worst States for Retirement in the U.S.

We have complied a list of states with information on healthcare costs, annual income and tax breaks. All the data was taken from the Kiplinger, Milken Institute, the National Association of Realtors, the Bureau of Labor Statistics and others. Read on to find out if your preferred retirement zone is on the list.

Massachusetts

Cost of living: 38 percent above the U.S. average

Population: 7.1 million

Best city: Northampton

PROS: Massachusetts is one of the original 13 colonies and a truly historic state. It is the landing site of the Mayflower, home to the Boston Tea Party and much more. Plus, it’s a great home for sports fans.

CONS: The Bay State has a lot of added costs for retirees. The cost of living is 38 percent above the national average, healthcare costs are high, and it is not tax friendly. Also, the winters get pretty cold. Unless you want to be shoveling snow during your retirement, it may not be the place for you.

Alaska

Cost of living: 32 percent above U.S. average

Population: 733,391

Best city: Anchorage

PROS: The Last Frontier is actually quite tax friendly to retirees, but it seems like not many are taking advantage of this fact. Despite its natural beauty, there is just a small population of retirees living in Alaska.

CONS: The Costs of living are high – 32 percent above the U.S. average. Health care in Alaska is also pricier than the national average, which is an important consideration for seniors. Most of the areas are rural and it is not a state for big city lovers, and don’t even get us started about the weather.

Ohio

Cost of living : 12 percent below U.S. average

Population : 11.75 million

Best city: Bellbrook

PROS: The central location of the Buckeye State makes it a relatively easy place to travel from to visit friends and family on either coast or just go on vacation. The cost of living is low at 12 percent below the U.S. average and Social Security is not taxed.

CONS: The low cost of living and Social Security exemption may seem attractive, but the average household income for people 65 and over is not high. If you have plenty of savings, Ohio may be the place for you, otherwise, be prepared to deal with an average income of $42,667.

Nevada

Cost of living : 4 percent above U.S. average

Population : 3.1 million

Best city : Winchester

PROS: Nevada is definitely a tax-friendly state, with no taxes on Social Security or any other retirement income and no state income tax! Poverty rates for seniors are lower than the national average (8.4 percent compared with 9.4 percent). Also, it is the home of the gambling paradise, Las Vegas.

CONS: The cost of living is slightly higher than the national average, but the temperatures can get way higher than average, ranging from 50 to 120 degrees Fahrenheit. Nevada’s desert climate makes it semi-arid year-round, which might make it the driest state in the country. The low humidity, however, can be good for people with allergies or breathing problems and may even help some skin conditions.

Washington

Cost of living: 21 percent above U.S. average

Population: 7.8 million

Best city: Vancouver

PROS: The Pacific Northwest is undoubtedly beautiful, and the laid-back lifestyle may be extremely appealing, but unfortunately, living there does not come cheap. Retirees looking for a slightly more affordable option can check out Vancouver. It is less pricey and there is no state income tax.

CONS: It’s impossible to ignore the fact that the cost of living is 21 percent above the U.S. average. That may be less than the most expensive states, but still challenging for those on a fixed income. The average income for households of 65 and over is above $55K, so that is something to take into account.

Mississippi

Cost of living : 15 below the U.S. average

Population : 2.98 million

Best city : Hide-A-Way Lake

PROS: Retirees may flock to the Hospitality State for its low prices and attractive tax breaks. They won’t have to pay any taxes on their Social Security, distributions from IRA’s and 401K’s, or any additional retirement income. Plus, the state has the lowest property tax in the entire nation.

CONS: Although Mississippi offers low living costs and great tax breaks, the state is actually ranked last for senior health in America. Sadly, it also has the worst poverty rate for seniors in the U.S. – 13.4 percent.

Florida

Cost of living : 1 percent above U.S. average

Population : 21.5 million

Best city : Jacksonville

PROS: Florida is one of the most tax-friendly states in America. Maybe this, along with its sunny skies, is the reason the Sunshine State has the highest share of seniors in the United States. The state benefits are also very financially secure.

CONS: The weather in Florida is unpredictable. The heat and humidity can be unpleasant, or even unsafe for retirees with health conditions. There is also the danger of hurricanes and powerful lightning storms. When there isn’t a hurricane warning, the weather is pretty nice…

Pennsylvania

Cost of living : 3 percent below U.S. average Population : 13 million

Best city : Pittsburgh

PROS: Pittsburgh is the best city in America to retire in, according to Forbes. You can get almost anywhere on foot or by bike and there is a high number of doctors per capita. The state of Pennsylvania is also generally good for retires with tax breaks and reasonably priced healthcare.

CONS: Pennsylvania’s budget is not well balanced, which makes its future financial policies unclear. States that are economically unstable (like Kansas), may raise taxes, which could affect retirees. Pennsylvania’s fiscal health was rated 45 out of all 50 states by George Mason University.

Georgia

Cost of living : 7 percent below U.S. average

Population : 3.97 million

Best city : Athens

PROS: The Peach State is famous for its warm weather and low cost of living. It also offers relatively cheap healthcare for seniors, the sixth-lowest for couples in the U.S. There are also low state taxes, which could help retirees that need to stretch their limited budget.

CONS: If you think Southern living could be for you, be sure to prepare for the hot summers. They are long and humid, and most people stay inside during the middle of the day to avoid getting too sticky. And be sure to pack a lot of bug spray to keep the mosquitos in check!

Missouri

Cost of living : 10 percent below U.S. average

Population : 6.16 million

Best city : Columbia

PROS: The low cost of living in Missouri, 10 percent below the national average, is extremely attractive to retirees. The Show-Me State is also a great destination for book lovers as the home of famous authors such as Maya Angelou, Mark Twain, and T.S. Eliot.

CONS: Although living in Missouri can be cheap, it may balance out with the low household income levels. For residents 65 and over, it is only slightly above $43K. The tax situation is a mixed bag and healthcare for seniors in not very good.

Kentucky

Cost of living : 14 percent below average

Population : 4.51 million

Best city : Lexington

PROS: In the Bluegrass State, retirees have access to a low cost of living and great tax breaks for seniors. Social Security and up to $41,100 of additional income are tax exempt. Although it is important to note that Kentucky living may not be the healthiest…

CONS: Healthcare for seniors costs about the same as in other states, but senior health is not rated well in Kentucky. The state’s seniors have high smoking rates, are not physically active and many of them live in poverty. There is also a shortage of quality nursing homes to care for retirees.

Alabama

Cost of living : 13 percent below U.S. average

Population : 5.1 million

Best city : Orange Beach

PROS: The Heart of Dixie is the place to be for an affordable retirement. The average spending of retired couples on healthcare is 4.4 less than in other states, income tax is from 2 to 5 percent and Social Security benefits are not taxed. There are also no state property taxes for people over 65.

CONS: The state sales tax is quite high and even applies to food. The weather can be unpredictable in spring and the month of November with plenty of rain and thunderstorms. Like other southern states, Alabama gets very hot in the summer months. Keep in mind that southern Alabama is hotter than the north.

Louisiana

Cost of living : 10 percent below U.S. average

Population : 4.67 million

Best city : Baton Rouge

PROS: With a below-average cost of living and plenty to see and do, Louisiana could be a great fit for some seniors. The state is filled with music and the tourist destinations of New Orleans and Baton Rouge. It is also known for its amazing food, interesting people and incredible natural swamps. There will certainly never be a dull moment.

CONS: Like many states in which the cost of living is low, the incomes are also low. The average per household for residents 65 and over is $50,744. That may make it difficult for retirees to afford necessities like healthcare, which is 2.1 percent more expensive than the national average.

Connecticut

Cost of living: 24 percent above the U.S. average

Population: 3.6 million

Best city: Darien

PROS: Connecticut retirees have some of the highest income in the nation. They may still be able to live there in style despite the high cost of living, if they find a suitable retirement job.

CONS: Connecticut is actually one of the least tax friendly states in the country. Almost all of retirement income is fully taxed and some residents may even have to pay taxes on their Social Security benefits. The state doesn’t offer much in the way of other benefits to make up for this policy.

Wisconsin

Cost of living : 4 percent below U.S. average

Population : 5.9 million

Best city : Madison PROS: The Badger State offers a low cost of living and tax breaks on the retirement income of low-income residents. It also has some of the best cheese in the country, and if you’ve never tried a cheese curd you’re in for a treat.

CONS: Wisconsin is not especially tax-friendly and has the lowest average household income for residents 65 and over in the country. Social Security is exempt, but all other retirement income is taxed. To make matters worse, healthcare costs are higher than the national average.

North Dakota

Cost of living: one percent above the U.S. average

Population: 786,729 Best city: Rugby PROS: North Dakota is tax-friendly for retirees with low-income tax rates of 1.1 to 2.9 percent and a low cost of living to boot. Plus, you would be hard-pressed to find a more beautiful natural landscape.

CONS: North Dakota taxes retirement income but that shouldn’t impact retirees greatly since the cost of living is low. Like South Dakota, this is not the place for city lovers with a population on only 786,729.

Delaware

Cost of living: 11 percent above U.S. average

Population: 989,948

Best city: Rehoboth Beach

PROS: Delaware was rated as tax-friendly. The state does not tax Social Security benefits and also exempts some investment and pension income for people over 60.

CONS: The cost of living is still 11 percent above the national average and seniors in the state have a below U.S. average income. When you combine these two things, it may be hard for some retirees to easily afford their essentials in Delaware.

Nebraska

Cost of living : 12 percent below the U.S. average

Population : 1.97 million

Best city : O’Neill

PROS: The Cornhusker State can offer retirees a very low cost of living and is in good condition financially. Nebraska is ranked sixth in the nation in fiscal health by the Mercatus Center at George Mason University.

CONS: Although the cost of living is low, Nebraska is not very tax-friendly to seniors with most retirement income taxable. The only way in which Social Security is exempt is if your income is less than $43,000 for single filers or $58,000 for joint filers.

New Mexico

Cost of living : 5 percent below U.S. average

Population : 2.1 million

Best city : Taos

PROS: Don’t believe everything you see on TV, New Mexico is nothing like Breaking Bad or Better Call Saul. It is a beautiful state with stunning views and a relatively peaceful way of life.

CONS: While the beautiful sunsets may fill your heart with joy, the tax situation will not. New Mexico is the “Least Tax-Friendly” state because Social Security, retirement income and pensions are all taxable. The state does offer certain exemptions for low-income seniors.

Virginia

Cost of living: 7 percent above U.S. average

Population: 8.6 million

Best city: Roanoke

PROS: The cost of living is higher than the national average, but senior incomes in Virginia are high, which could balance things out. Healthcare, which is an important issue for retirees, is mostly reasonably priced. Plus, Social Security is not taxed and residents who are 65 and over can deduct $12K of their income.

CONS: Retirees on a tight budget may have a hard time with the higher than average cost of living. And although Virginia has plenty of nice cities like Richmond, Lexington, and Roanoke, they don’t have the big city feel of New York or Los Angeles. If you are looking for a major metropolis, Virginia is probably not right for you.

Colorado

Cost of living: 17 percent above U.S. average

Population: 5.4 million

Best city: Colorado Springs

PROS: The United Health Foundation ranked Colorado as fourth in senior health rankings in the nation. The state’s seniors also have low rates of obesity and physical inactivity compared to other places. Does that mean that Colorado’s retirees will live longer and healthier lives?

CONS: Buying a house in Colorado is not easy, it can become downright competitive in desirable cities like Denver. The high altitude can also be an adjustment, but after you get used to it, you will probably enjoy the nice weather, until winter that is.

South Carolina

Cost of living : 7 percent below U.S. average

Population : 5.2 million

Best city : Bluffton

PROS: South Carolina, not surprisingly, also has year-round mild weather which makes it an appealing place for retirees. The Palmetto State is also quite affordable, with a cost of living that is seven percent below the U.S. average. It is also tax-friendly for retirees, leaving more money to spend on your quality of life.

CONS: Although the weather is usually mild, the summers in this southern state can get hot and humid. Plus, South Carolina is not the healthiest state around, with plenty of smokers, rising obesity levels and a low consumption level of fruits and vegetables.

Rhode Island

Cost of living: 22 percent above U.S. average

Population: 1.1 million

Best city: Jamestown

PROS: Rhode Island is a historic place to live. It is one of the 13 original American colonies and has a lot to offer to history buffs, and with stunning ocean views, also to nature enthusiasts. There is also plenty to see and do in this small state, with tourist attractions and metropolitan areas.

CONS: Unfortunately, says that “Little Rhodie” is not very tax friendly. If you take into account the high cost of living, which is 22 percent above the national average, that could put a real strain on a senior’s budget. However, if you are independently wealthy, have family support or have recently struck it rich, Rhode Island may be the place for you.

Tennessee

Cost of living : 12 percent below U.S. average

Population : 6.95 million

Best city: Lookout Mountain

PROS: Tennessee is a tax-friendly state for retirees. There is no state income tax, which means a little more bang for your buck. Everyday living in metropolitan areas is quite affordable, including the price of healthcare which is quite important to seniors.

CONS: The weather in summer can be intolerable, with July temperatures reaching 92 degrees Fahrenheit. If you throw in some humidity, the summer months may seem like they are never going to end. There is also the traffic situation, which can get quite bad, especially in the bigger cities like Memphis and Nashville. If you are planning a trip out of town, make sure to bring some patience.

Arizona

Cost of living : 3 percent above U.S. average

Population : 7.2 million

Best city : Green Valley

PROS: Arizona is famous for its sunshine, striking desert landscape, and its Grand Canyon national park. The weather makes it the perfect retirement option for those who have faced too many freezing winters. It is a more affordable retirement option than expensive states like New York or California, with a cost of living just three percent above the national average.

CONS: The dry heat of Arizona is almost impossible to bear during the summer, with temperatures in some places reaching between 104 and 107 degrees Fahrenheit. It is also not the most inexpensive place to live with an average income for senior households that is 10.8 percent below the U.S. average.

South Dakota

Cost of living : 4 percent above U.S. average

Population : 884,659

Best city : Hot Springs

PROS: The state famous for Mount Rushmore was ranked as one of the most tax-friendly states. South Dakota is not only affordable but extremely scenic. With many trails and views of mountains and prairies to enjoy.

CON: North Dakota is not ideal for those who don’t like icy weather and blizzards. It is extremely rural, with no big cities in sight, and is one of the least populated states in the nation. City lovers should probably go elsewhere.

California

Cost of living: 52 percent above the U.S. average

Population: 39.46 million

Best city: Beverly Hills

PROS: California is an inarguably beautiful place. It is the state that has everything: beaches, forests, deserts, and a variety of national parks. For those seeking a more fast-paced lifestyle, California also offers numerous big cities.

CONS: California is the state with the second-highest cost of living, only behind Hawaii. If you want to enjoy year-round sunshine, it’s going to cost you! Sadly, it seems like many people are paying the price, 19 percent of the population in California lives in poverty.

Hawaii

Cost of living: 87 percent above U.S. average

Population: 1.46 million

Best city: Maunawili

PROS: Maunawili on the island of Oʻahu is the most recommended city for retirees in the Aloha State. It features a golf course, beautiful hiking trails and is close to the Hawaii capital of Honolulu. Hawaii is widely known for its beautiful landscapes and abundant water sports.

CONS: Hawaii is expensive! The cost of living is a whopping 87 percent above average. That is even higher than the pricey California. According to Kiplinger, the average income for people 65 and over is above $71K, so that is something to consider. It is also expensive to get off the island, so visits to the grandchildren may become infrequent.

Kansas

Cost of living : 14 percent below average

Population : 2.95 million

Best city : Eureka

PROS: The cost of living in Kansas is a whopping 14 percent lower than the national average, which may explain why Dorothy thought there was no place like home. The Sunflower State also has plenty to offer nature lovers with beautiful prairies and plains.

CONS: Due to its less than ideal financial situation, Kansas is raising taxes to resolve its budget deficit. Social Security and most other retirement incomes will be taxed with rates ranging from 3.1 to 5.7 percent. That is something that may affect your standard of living if you are on a tight budget.

New Hampshire

Cost of living: 18 percent above the U.S. average

Population: 1.38 million

Best city: Gilford

PROS: New Hampshire is quite tax friendly for seniors, not taxing any of their retirement income. If you have health issues, the Granite State was ranked fifth for senior health by the United Health Foundation. It is also a beautiful place, with scenic New England landscapes and colorful autumn leaves that can’t be beat.

CONS: Beautiful scenery doesn’t come cheap, however. New Hampshire has a fairly high cost of living compared to the national average, but you may be able to make it work if you take the tax breaks into account. Plus, let’s not forget the weather. Freezing winters and humid summers may not be ideal for retirees.

Indiana

Cost of living : 15 percent below U.S. average

Population : 6.8 million

Best city : Meridian Hills

PROS: The Hoosier State has a cost of living which is 15 percent lower than the U.S. average which means retirees can save a lot on essentials like food and housing. Compare that to California or Hawaii and you’ll see that your money can go a lot further there. There is a lively art scene and plenty of outdoor activities to do in spring and summer.

CON: Despite the low cost of living, Indiana is better for retirees who saved their pennies because the annual income is way below the national average (21.4 percent lower). Also, all retirement income except Social Security is taxed at regular rates and the winters are freezing.

Utah

Cost of living : 4 percent above U.S. average

Population : 2.9 million

Best city : Salt Lake City

PROS: Utah offers good healthcare for seniors. It is ranked second in the country according to the United Health Foundation. The Beehive State is also famous for its outdoor activities, with five national forests, five national parks, and 43 state parks.

CONS: Utah is not tax-friendly to its seniors. It taxes Social Security benefits, which may add a burden to retirees who are already struggling financially. Utah has the third-lowest poverty rate in the country for seniors and its income levels are about average. So, it is probably not the best place to head if you are already struggling to make ends meet.

Wyoming

Cost of living : U.S. average Population : 573,909 Best city : Cody

PROS: The Equality State was rated fifth in fiscal health out of all fifty states by the Mercatus Center, which is pretty impressive. Retirees can also save some money because there is no state income tax.

CONS: Wyoming is not a good fit for city folk. If you don’t love nature, you won’t find much to do there. It also has one of the smallest populations in America at 573,909, with no big cities to be found. It is impossible, however, to ignore the natural beauty of the state.

Texas

Cost of living : 10 percent below U.S. average

Population : 29.2 million

Best city : San Marcos

PROS: The cost of living is 10 percent below the U.S. average and the average income for residents 65 and older is fairly decent. Texas also doesn’t tax income heavily, leaving more dollars in your wallet. Austin and Dallas are great cities with plenty of things to do.

CONS: Texas is a good financial option except for its healthcare, which is an important issue for retirees. Unfortunately, the poverty rates in Texas are high. The state has the sixth-highest senior poverty rates in the country, at 10.8 percent.

Iowa

Cost of living : 12 percent below U.S. average

Population : 3.21 million

Best city : Iowa City

PROS: Iowa is great for retirees with no state income tax on Social Security earnings and an income tax break for pension income. UNESCO designated Iowa City as a “City of Literature” in 2008, and it also features a famous university and a lively cultural scene.

CONS: Although Social Security benefits are exempt, Iowa is not all that tax-friendly for seniors. Other retirement income can be taxed up to 8.98 percent. Residents over 55 do have the option of excluding up to $6,000 of taxable retirement income.

Oklahoma

Cost of living : 16 percent below U.S. average

Population : 3.97 million

Best city : Nichols Hills

PROS: With one of the lowest costs of living in the country, retirees with savings can stretch their money much further in Oklahoma. There is also no tax on Social Security benefits and up to $10K of retirement income can be excluded. It also has no state estate tax and property taxes are low. The winters are mild and there is sunshine during most days of the year.

CONS: The low cost of living comes with low incomes. Senior health is ranked as the third-worst in the nation. There are also high levels of smoking and physical inactivity and a deficiency in proper nursing home and general geriatric care to address the health issues.

Maryland

Cost of living: 17 percent above U.S. average

Population: 6.2 million

Best city: Chevy Chase Village

PROS: The average income per household for people 65 and over in Maryland is the second highest in the nation, an average of $70,874. Plus, Maryland is home to the thriving metropolitan city of Baltimore and quite close to the sights and monuments of Washington D.C.

CONS: The income in this state may be high in comparison to the rest of the country, but it is also highly taxed. Social Security is exempt, but distributions from individual retirement accounts are not. Maryland also has an inheritance and estate tax.

Vermont

Cost of living: 12 percent above the U.S. average

Population: 643,077

Best city: Hartford

PROS: The Green Mountain State provides good healthcare for its seniors. Retirees who love nature will enjoy the natural beauty of this state, full of trees, water, wildlife, and amazing scenery.

CONS: The home state of Ben & Jerry’s ice cream is known as one of the “Least Tax-Friendly.” That and the cost of living, which is somewhat higher than the national average, may make it hard for retirees on a budget to live well.

West Virginia

Cost of living : 17 percent below U.S. average

Population : 1.784 million Best city : Lewisburg PROS: With a cost of living that is 17 percent less than the national average, The Mountain State can be quite affordable. It also has beautiful mountains and forests, luxurious resorts, a rich history and much more, according to USA Today.

CONS: West Virginia is not very tax-friendly for retirees. It’s lowly ranked for its fiscal soundness by the Mercatus Center at George Mason University. Average incomes are low and healthcare for seniors is below-average.

Michigan

Cost of living : 12 percent below U.S. average

Population : 10.2 million

Best city : Farmington

PROS: Michigan is appealing for retirees due to its low poverty rate and extremely low cost of living. The Great Lakes State also doesn’t tax Social Security benefits. If you love water sports or just looking at some beautiful scenery, you can enjoy the Great Lakes during spring and summer.

CONS: Michigan went through some tax changes which made things tricky for retired folks. Residents who are 67 and over have to choose between deducting Social Security income or a set amount from all their income sources: $20K for singles, $40K for couples.

Oregon

Cost of living: 18 percent above U.S. average

Population: 4.27 million

Best city: Gold Beach

PROS: Oregon offers seniors slightly lower healthcare costs than other states, 2.6 percent lower than the national average. It also offers a multitude of outdoor activities for active pensioners to enjoy, if they don’t mind the rain. There sure is a lot of it during the eight-month long rainy season.

CONS: Oregon is not a very tax friendly state. Social Security is not taxed, but most other retirement income is. The state also has one of the highest state income taxes – 9.9 percent. Plus, the average income for seniors is on the low end, just over $45K.

Montana

Cost of living : 3 percent above U.S. average

Population : 1.09 million

Best city : Glasgow

PROS: A cold but majestic state, Montana is the home of natural wonders like Yellowstone and Glacier national parks. Big Sky Country has one of the highest populations of seniors in the United States.

CONS: Montana may be beautiful, but retirees may not always have an easy time living there. With income levels below average and most retirement income including Social Security taxed. Plus, if you are not a nature lover, you may find Montana downright boring. Don’t forget to take your lifestyle into account before making this important decision.

Illinois

Cost of living : 4 percent below U.S. average

Population : 12.78 million

Best city : Leland Grove

PROS: The fiscal standing of the state of Illinois has been on a downward trend for some time. The upside of that is that the cost of living is below the national average, which could make it affordable for retirees. The small town of Leland Grove was rated as the best place to retire in Illinois by Niche. It has a suburban feel, but also offers many restaurants and coffee shops.

CONS: Unfortunately, the state’s financial standing has earned it the second-lowest ranking for fiscal soundness. That means that tax breaks on retirement funds may not remain in place and there is also a high sales tax.

Idaho

Cost of living : 5 percent below the U.S. average

Population : 1.6 million

Best city : Sandpoint

PROS: Idaho’s rugged landscape is breathtaking. Nature enthusiasts will be able to enjoy snow-capped mountains, canyons, and lakes. Its below-average cost of living will allow seniors to make the most of their income and enjoy their retirement with less financial pressures.

CON: Once again, Idaho is not for you if you are craving the excitement of a big city. There are no major metropolitan areas in the state. Taxwise for seniors, there are pros and cons. The state tax is six percent, and the state income tax is above seven percent, but Social Security is not taxed and there are no inheritance or estate taxes.

Arkansas

Cost of living : 17 percent below U.S. average

Population : 3 million

Best city : Bella Vista

PROS: The Natural State offers an impressively low cost of living and the third lowest healthcare costs for retired couples around. It is renowned for its natural beauty, wildlife, hot springs, rivers, and mountains and has plenty of outdoor pastimes to excite the active senior.

CONS: The taxes in Arkansas are steep. Most retirement income is taxed and only Social Security and up to $6,000 of other retirement funds are exempt. Income tax rates can go as high as 6.9 percent, if your income is over $75,000. The state has the eighth-highest poverty rate for seniors in the nation. There is also not a big city anywhere to be seen and the state gets more than its fair share of tornados.

Minnesota

Cost of living : 4 percent above U.S. average

Population : 5.7 million

Best city : Osseo

PROS: If you have health problems or are worried about having them, Minnesota could be the state for you. It was ranked as the “healthiest in the country for seniors” by the United Health Foundation. It is also the home of the world-famous Mayo Clinic in Rochester. This state is a good choice for the health-conscious.

CONS: Unfortunately, Minnesota has an unideal combination of a slightly higher than average cost of living with below-average annual income. It also taxes Social Security as much as the Federal government and doesn’t exempt other retirement incomes. Plus, the winters are extremely cold and snowy.

North Carolina

Cost of living : 5 percent below U.S. average

Population : 10.5 million

Best city : Asheville

PROS: With mild temperatures and mostly comfortable weather all year round, North Carolina could be a nice change for retirees who are sick of cold winters or hot summers. The cost of living is below average and real estate is pretty affordable if you are not looking in the Kill Devil Hills area. Also, Social Security benefits are not taxed.

CONS: The cost of living may be low, but so are the incomes with an average of $43,616 for residents that are 65 and over. And although Social Security is not taxed, other retirement income is, at a set rate of 5.9 percent.

Maine

Cost of living : 2 percent below the U.S. average

Population : 1.3 million

Best city : Portland

PROS: The perfect place for seafood lovers, you’ll never have a problem getting fresh lobster in Maine. With the cost of living and healthcare costs below the national average, retirees can get more bang for their buck in the Pine Tree State.

CONS: While the tax situation in Maine is not bad, it is not great either with most retirement income taxable. On the other hand, Social Security is exempt and estate tax only applies to expensive estates worth $11.8 million or more. Income levels are not high. Senior households bring in 25.2 percent less than the U.S. average.

New Jersey

Cost of living: 27 percent above U.S. average

Population: 9.4 million

Best city: Long Beach Township

PROS: The Garden State has a lot to offer retirees. There are many things to see and do, including walking the famous boardwalk or sitting on a bench and enjoying the view in Ocean City. With the great New York City only a train ride away. New Jersey is also rife with history for those who love to learn.

CONS: When you consider the quality of life in states such as South Dakota and Montana, New Jersey has a much higher cost of living. Health care and property taxes are also expensive. This state would not be a good fit for seniors who are on budget or are trying to get the most out of their pensions.

New York

Cost of living: 22 percent above U.S. average

Population: 18.823 million

Best city: Great Neck

PROS: The New York City lifestyle could be a good fit for retirees. There is no need to drive, and most things are walking distance, with many delivery options and shops and restaurants right around the corner. Plus, the small living spaces are more manageable and require less maintenance.

CONS: New York City and State may have a lot to offer but they are best suited to the more financially secure retirees. The state is not very tax friendly and there are high poverty rates for residents that are 65 and over.

So, Who knew these were the worst places to retire?

The combination of good healthcare, a low cost of living and low taxes is what makes a certain state the best option for retirement. Although some states are known for their good weather or offer many activities, that does not necessarily mean they are the right place for you to spend your Golden Years. These are the worst states to retire to on the East and West Coasts.

They include Massachusetts, New Jersey, Maryland, New York, Rhode Island, Connecticut, and California. California has a cost of living which is 52 percent above the national average, but the least tax-friendly are Maryland, Connecticut, Massachusetts, Rhode Island, and New York! If you plan on staying in or moving to these states, make sure you are putting away plenty of money for your retirement.

Servers Share More Valentine’s Day Disaster Stories

Celebrity Families: These Grandchildren Look Exactly Like Their Celebrity Grandparents!

Natural Remedies to Keep Fleas Away From Your Pet

The Biggest and Best Celebrities & Their Bodyguards

The Greatest Westerns of All Time Part 2

These Instagrammers Took Their Photo Edits to the Very Extreme

Hilarious Senior Yearbook Quotes That Cannot Be Unseen

Get To Know The Best Guitarists Throughout History

Honest Depictions of History’s Greatest Figures

Costco: What to Buy and What to Steer Clear of at the Bulk Grocer