What Would Happen If The United States Never Paid Back Its Debt?

Despite being one of the richest countries in the world, the United States has long been a country in debt, and in recent years, the amount it owes has grown to unprecedented levels. In 2020, the U.S. deficit stood at $3.13 trillion — meaning that the country’s public spending had gone that much over budget — while the total government debt stands at $28.3 trillion, per a CNBC report published in July 2021.

In June 2021, U.S. Treasury Secretary Janet Yellen warned Congress that the country risked defaulting on its debts — which she argued “would have absolutely catastrophic economic consequences” — if new legislation was not passed before the August recess. Market Realist reports that the U.S. debt ceiling is constantly being raised by Congress in such a way as to avoid defaults. But if for whatever reason the U.S. did indeed default on its debts, the same source agrees with Yellen that the fallout would be “dire.” Interest rates would soar while the value of the dollar would crash, and climbing prices would soon make the cost of living unmanageable for the vast majority of American workers, whose wages would simultaneously stagnate. But is the U.S. defaulting on its debts really a possibility? And should we be worried about it?

Hyperinflation and Alan Greenspan's magic money tree

Alan Greenspan, who previously chaired the Federal Reserve of the United States, attracted ridicule after he argued that there is zero chance of the U.S. ever defaulting on its debts as the country can simply print more money if ever it was needed. According to Business Insider, the claim is ridiculous in part because the U.S. is constantly printing money.

Indeed, there are many commentators who question the wisdom of just creating new money whenever you need it, pointing out quite sensibly that to do so runs the risk of devaluing the currency itself. Notably, critics of the idea often recall the hyperinflation crisis that hit the Weimar Republic of Germany in 1923, when a loaf of bread that had cost 250 marks at the start of the year was worth 200,000 by November, according to the BBC. In addition, workers found themselves having to use wheelbarrows to collect wages paid in an almost worthless currency.

But is hyperinflation something Americans should worry about? Not according to leading economist Asher Rogovy, who explains via Investopedia: “In the U.S., the central bank does not pay debt with the money it creates. Rather, it lends money at its targeted interest rate and the private sector employs that capital more productively. The money created is paid back, which is a crucial reason this monetary policy doesn’t produce hyperinflation.” Meanwhile, other experts have described the peddling of hyperinflation as an economic risk as a “scam,” per the same source.

Why Zhu Yuanzhang Is One Of History's Most Successful Rebels

Inside The Tragic Death Of Race Car Driver Gordon Smiley

The Untold Truth Of The Four Horsemen Of The Apocalypse

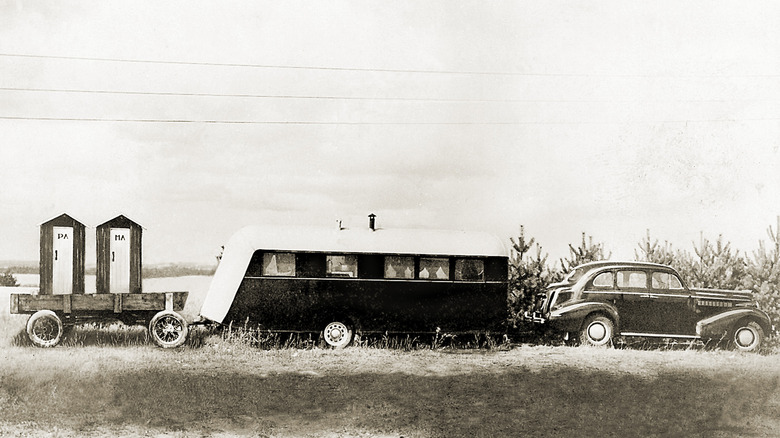

The Untold Story Of The First RVs

Son Of Sam: What David Berkowitz's Life In Prison Is Really Like

This Is What Would Happen If The Internet Collapsed

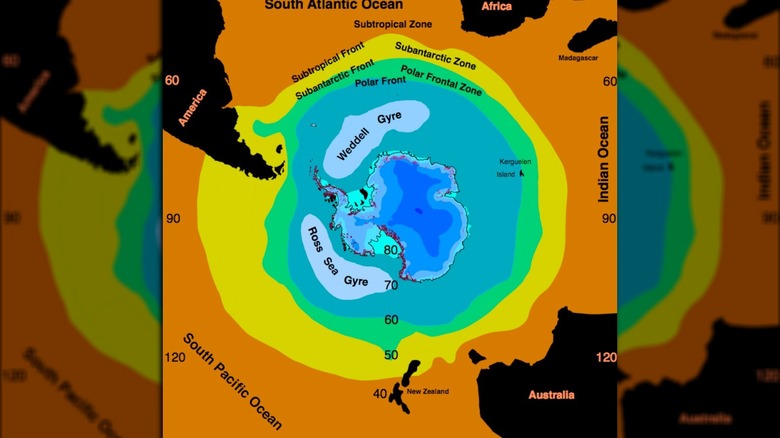

The Truth About The World's Fifth Official Ocean

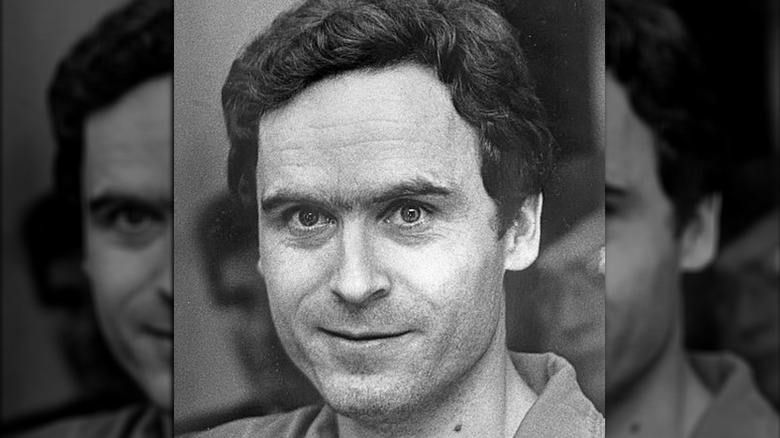

What It Was Like Serving On A Ted Bundy Jury

These Are Ozzy Osbourne's Three Biggest Regrets

How Twisted Sister's Dee Snider Lost All His Money