Why Is Healthcare So Expensive?

When emergency room nurse Lauren Bard gave birth to her daughter, Sadie, three months prematurely in 2018, she was certain that her employer had her back financially. After all, she worked at a hospital owned by Dignity Health, a company that adopted the mantra, “Hello humankindness.” But humankindness ended where the price tag began.

As ProPublica describes, three days after giving birth to Sadie, who weighed under a pound and a half, Bard contacted her insurer, which assured her that the girl was covered. As a result, she unwittingly missed the 31-day deadline Dignity Health set for registering newborns through its website. Naturally, the already stressed-out Bard was utterly stunned when she received a bill for $898,984.57. If she agreed to pay monthly installments of $100, it would have taken her 748 years to erase the bill.

Bard was one of the lucky ones. After ProPublica publicized her story, Dignity Health suddenly remembered Bard’s dignity and agreed to cover some of Sadie’s hospital costs. But as the progressive Vermont Senator Bernie Sanders has frequently pointed out, about 500,000 Americans are bankrupted by humongous medical bills every year. And as Rolling Stone points out, the medical journal Sanders cited provided a higher estimate — roughly 530,000 Americans suffer financial calamity annually because of medical expenses. That’s despite the implementation of the rather ironically named Affordable Care Act, a.k.a “Obamacare.” Let’s take a look at the history and the travesty of American healthcare.

A history of vileness

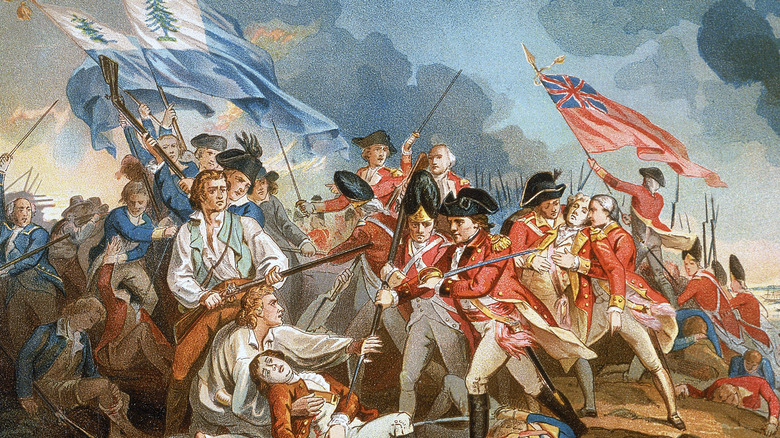

Why is it that citizens in the richest country on Earth are charged so much money for not dying that many go broke and even end up living on the streets? In a 2017 article for Stanford Medicine, the editor-in-chief of Kaiser Health News, Elisabeth Rosenthal, MD, writes: “The very idea of health insurance is in some ways the original sin that catalyzed the evolution of today’s medical-industrial complex.” Perhaps the earliest version of that system dates back to the 1890s, when lumber companies in Tacoma, Washington paid a pair of doctors 50 cents monthly to treat employees.

In the early 1900s, the Baptist Church at Baylor University Medical Center in Texas inadvertently invented modern health insurance. It began with a 14-room mansion dubbed the Texas Baptist Memorial Sanitarium. When attorney and Baylor vice president Justin Ford Kimball discovered the sanitarium had racked up unpaid bills, he struck a deal with teachers who would pay 50 cents a month plus a deductible for the right to a 21-day stay.

Baylor’s system caught on like a cold, and World War II helped cement the ill-fated system. Employee numbers dwindled during the war, so companies offered health insurance to lure new hires. The federal government further incentivized the practice by making employer expenditures for health employee healthcare tax-exempt. This arrangement wasn’t meant to lower overall medical costs but to blunt the impact of catastrophic events. In the 1950s and ’60s the popularity of health insurance skyrocketed, and profit-hungry companies sprang up to capitalize on demand.

Domestic violence and pregnancy as pre-existing conditions

The fundamental pitfall for consumers in a for-profit healthcare system is that the insurance is inherently designed to cater to all who want it but don’t really need it. As recounted in the Standord Medicine article “Insurance policy: How an industry shifted from protecting patients to seeking profit,” in the 1950s, for-profit insurance providers like Aetna and Cigna started charging different rates based on age and trying to attract younger, healthier customers. Such companies also forged closer connections to the business world. This created a conundrum for competitors Blue Cross and Blue Shield, which had committed themselves to “providing high-quality, affordable health care for all.”

Left to care for the sickest patients, the financially ailing Blue Cross and Blue shield switched to for-profit status in 1994, effectively killing off what Rosenthal calls “old-fashioned noble-minded health insurance.” According to Kaiser Health News, in that same year, an informal survey by the Senate Judiciary Committee “found that eight of the 16 largest U.S. insurers used domestic violence as a factor in deciding whether to offer insurance coverage and how much to charge.”

Subsequent surveys by insurance commissioners in Kansas and Pennsylvania indicated that a quarter of insurance companies looked at domestic violence when weighing whether to renew insurance policies. Companies even penalized women for having children. Per Politifact, in 2009, 39 states permitted insurers to deny coverage for “virtually any reason.” Pregnancy “almost always” counted as a potentially disqualifying pre-existing condition.

The cynical calculus of premiums and deductibles

As summarized by the Kaiser Family Foundation, the 2010 Affordable Care Act (ACA), commonly referred to as Obamacare, aimed to make health coverage more comprehensive, cheaper for people who already had insurance, and accessible to citizens who were previously barred by pre-existing conditions. However, the results have been mixed. While the ACA’s Medicaid expansion provided vital help to people who went far too long without coverage, people insured through their employers have been increasingly crushed by soaring deductibles.

In 2015, physician Praveen Arla told USA Today that the state of healthcare “flip-flopped” from what it was before the ACA. According to Arla, patients with employer-based insurance would often lament, “‘My deductible is so high. I’m trying to come to the doctor as little as possible.” Meanwhile employers have increasingly gravitated toward high-deductible insurance plans as a cost-cutting measure. Citing the Centers for Disease Control and Prevention, CBS reported in 2019 that four in 10 Americans have high-deductible plans.

Assuming patients don’t eschew healthcare altogether, the basic alternative would entail paying a lower deductible but a prohibitively high monthly premium. Either way the fees for procedures and medications can be outrageous. For example, adjunct professor Robyn Hodgson couldn’t purchase pain medication after back surgery due to the $7,300 deductible she’d have to pay before her insurance chipped in. She received that coverage through her husband’s job, which cost them $6,500 a year in premiums.

A clean bill of health comes with a filthy bill of goods

In 2019, NPR shared the story of 27-year-old Brianna Snitchler. Snitchler trusted her employer-provided insurance and her primary care physician but eyed her abdominal cyst with suspicion. After it grew to the size of a quarter she grew concerned about the possibility of cancer and underwent a biopsy. Thankfully, the cyst was benign. Too bad the cost of the procedure wasn’t. Snitchler received a $3,357.52 bill, most of which was for “operating room services.” This service charge amounted to $2,170, or about 65 percent of the entire cost. Much to Snitchler’s chagrin, the hospital had no legal obligation to tell her about the OR charge. And much to the dismay of many patients, hospitals have a longstanding tradition of adding massive, unexpected fees to medical bills. In 2013, author, attorney and Court TV founder Steven Brill painted a bleak picture of the predicament.

Writing for Time, Brill describes how hospitals rely on an internal system called the “chargemaster” to assign prices for procedures, drugs, medical equipment, and miscellaneous items. Some charges might seem arbitrary, with hospitals billing patients for lamp shades and IV tubing. Adding insult to literal injury, those fees are severely inflated. Brill observed that a blood test that cost $13.94 through Medicare was assigned price tags of $199.50 and $239 respectively to two separate patients.

Tricks of the drug trade

According to a Rand Corporation report from 2019, the world collectively spends around $1 trillion on drugs annually. The United States accounts for about half of that total despite making up only five percent of the global population. Preposterously, three percent of America’s entire GDP comes from drug costs. But while the prices patients pay far outpace the rest of the world, the results lag behind other developed nations. The Harvard Gazette says that in 2016, the U.S. spent twice as much on healthcare as other high-income countries but ranked dead-last in life expectancy on a list of 10 other countries.

Why does America so much more for less? The Rand Corporation observes that “every other country in the world regulates drug prices, typically through some formal process of negotiation. Only we don’t.” Instead, pharmaceutical companies call the shots. The FDA effectively allows them to monopolize drugs via patents. And because greed is bottomless, drug companies boost their bottom lines by exploiting legal loopholes.

As USA Today details, drug patents generally last 20 years. Once you subtract the time it takes for approval, pharmaceutical manufacturers can “expect anywhere from seven to 12 years of protection.” However, they can extend that time through the dubious practices of “evergreening” and “thickening.” Thickening entails inundating the courts and Patent Trade Office with applications in order to overwhelm the system. “Evergreening involves making small alterations to a drug” even something as insignificant as “adding a stripe to a pill” and applying for a new patent.

Drive-by doctors and lobbyists stack the deck and their cash

Every severe medical problem is a horror story in its own right. You might imagine the villain as an illness or tragic accident, but sometimes the very physician who saves is secretly the main antagonist, particularly when that physician commits “drive-by doctoring.” Forbes policy editor Avik Roy explains that drive-by doctoring occurs when a doctor outside your insurance network treats you without your knowledge, which can result in extraordinary out-of-pocket fees.

In an especially nightmarish case of drive-by doctoring, bank technology manager Peter Drier underwent spinal surgery and may have been visited by an out-of-network physician while unconscious. Drier only owed $3,000 in out-of-pocket costs for the work done by his in-network surgeon. Yet the out-of-network physician who didn’t perform the operation sent Drier a $117,000 bill. Roy writes that drive-by doctoring “is especially egregious in emergency rooms” due to the “free rein” afforded to physicians and the often disoriented or outright incapacitated state of patients.

You might think that lawmakers could remedy the situation. Unfortunately, according to Kaiser Health News, physician-led groups have vociferously lobbied Congress to quash measures that would lower these surprise bills. Similarly, calls to overhaul the healthcare system have also met strong resistance from lobbyists. Per The Intercept, pharmaceutical and other healthcare industry lobbyists have also pressured the Democratic Party to oppose any measures that would push the country toward “Medicare for All,” instead urging them to take a more “moderate position.” It’s unclear if America will cure its sick healthcare system. But current diagnosis is dire: for far too many struggling citizens, “healthcare” is little more than an oxymoron.

How Heaven's Gate Used The Promise Of UFOs To Lure Their Victims

The Most Dangerous Rivers On The Planet

Creepy Stories About Colorado's Famous Stanley Hotel

What You Need To Know About The Mysterious Bennington Triangle Disappearances

The Truth About The Octavius Ship

Mineral Found In Meteorite Never Seen In Nature Before

The Best Place To Sit If Your Plane Is About To Crash

The Untold Truth Of North Korea's Hotel Of Doom

How To Survive A Nuclear Attack

The Long List Of Stars Who Strangely Died At Age 27